Shipping containers are piling up on the Portland waterfront at a record pace as the state invests millions of dollars into its largest port to encourage Maine’s growing trade links to Europe and the North Atlantic region.

The volume of containers moving through the International Marine Terminal on West Commercial Street has more than doubled in the past five years and so has the value of goods, to $502.7 million last year. Containers full of paper products, candles and cranberry juice are hoisted onto ships bound for foreign ports while cranes unload boxes and boxes of frozen fish from vessels delivering goods to Maine.

“That port is doing very, very well. We have a lot of construction going in a very short amount of time and we are thrilled with the way it has come together,” said Jon Nass, deputy commissioner of the Maine Department of Transportation.

But as the port develops, a waterfront cold-storage warehouse, seen as a critical piece of infrastructure, has yet to get off the ground. First opposed by neighbors because of its aesthetic impact, the warehouse project is now complicated by an unstable building site and an uncertain public-private partnership. It is still unclear when the building might be constructed.

Despite the challenges, Maine authorities are committed to a cold-storage facility to maintain a relationship with the Icelandic shipping firm Eimskip and to help grow Maine’s food and beverage industries.

“Something is going to happen down there, we are very confident about that,” Nass said.

TERMINAL TRAFFIC UP

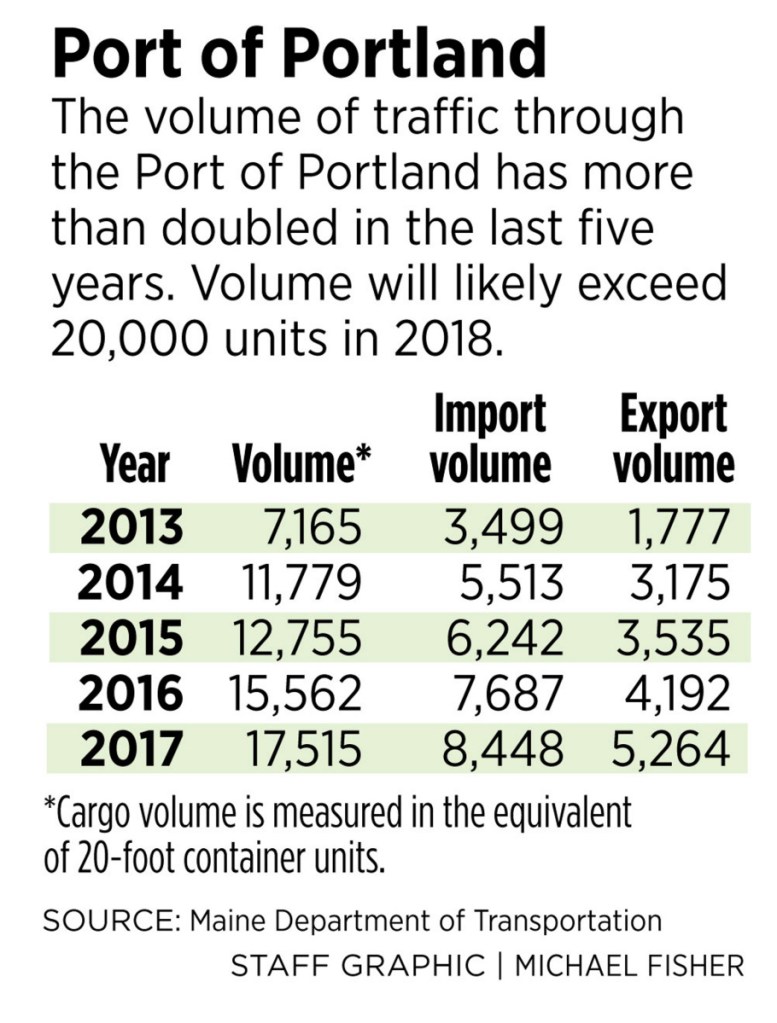

Last year, 17,515 container units came through the port, almost 13 percent higher than the year before and more than double the 7,165 units recorded in 2013. The International Marine Terminal is Maine’s only container terminal.

The Maine Port Authority anticipates 52 vessel calls to the terminal and around 20,000 container units this year, said Matt Burns, the authority’s acting executive director.

The value of products coming through Portland has increased at about the same pace as container volume. Combined import and export value through Portland was $502.7 million last year, more than twice that of five years ago, according to trade figures from the Maine International Trade Center.

“The numbers are staggering, honestly. I couldn’t believe the growth,” said the center’s president, Wade Merritt. Imports are still two-thirds of total value and almost 80 percent of weight, but exports have caught up fast in the last five years, growing from 18 percent of value in 2013 to 32 percent last year, Merritt said.

Imports are dominated by fish products – the top three imported products in 2017 were frozen fillets of cod, salmon and haddock worth $108.9 million – but also include mineral water, newsprint, medical machinery and a plethora of food and beverage items.

Top exports from Portland include frozen cranberries and cranberry juice, candles, frozen scallops, paperboard and bullet cartridges and parts.

Not all of Portland’s export value is from Maine-made products, but the rapid growth indicates local businesses are developing markets in Europe and the North Atlantic, a development the trade center has been encouraging for years, Merritt added.

“What the numbers are showing now is that because of the consistency of Eimskip’s service and the buzz about markets, Maine companies are starting to look that way,” he said.

NEW INFRASTRUCTURE, NEW ROUTES

Eimskip accounted for 66 percent of all containers at the Portland terminal last year, about twice the number carried by road and rail combined.

The container shipping company started regular stops in Portland and made the city its U.S. headquarters in 2013.

“In the last five years, we doubled the volumes we brought through the port; in the next two and a half (years), we want to double it again,” said Larus Isfeld, managing director of Eimskip USA. “Once we have that done, we are looking at bringing in larger vessels.”

Eimskip has expanded its shipping network through Canada, Scandinavia and Western Europe, and started weekly service to Portland in January. It also made an agreement with French global shipping corporation CMA CGM to link container shipments from Portland to seven ports in Southeast Asia by transiting through Halifax, Nova Scotia, a move expected to drive more growth, Isfeld said.

What the company doesn’t have, and has been waiting for, is cold storage at the port. Eimskip specializes in refrigerated cargo and currently uses electrical hookups at the Portland terminal to keep refrigerated containers cold.

“It is something we needed four years ago,” Isfeld said of the cold-storage facility.

“It does hamper growth and how fast we can grow,” he added. “We have always called on ports that have cold storage. We went into this relationship with it very high on our list that cold storage needed to be developed in some capacity.”

Since 2009, Maine has spent tens of millions of dollars to update and expand the International Marine Terminal, adding a direct rail link among other improvements. The state is in the midst of another $15.5 million investment that will double capacity with a new crane, pier extension, new buildings and expanded container space.

“The infrastructure improvements increase container capacity and increase reliability and speed we can give to customers,” said David Arnold, CEO of Soli DG, the private company that manages the terminal. “That means we are better positioned to attract customers, who, if that reliability were not there, would not move freight through the port.”

The terminal employs about 25 people full time.

PROSPECTS OF COLD STORAGE FACILITY

While all signs point to another strong year in 2018, the absence of cold storage is a drawback for the growing terminal.

“That piece of infrastructure has a lot of potential to do a lot of good for a lot of people,” Arnold said. “All of that to say, the port is operating without it currently. However, our customers are paying a premium to use cold storage elsewhere. Given how many factors can play into the cost of transportation, the higher cost of moving a box through our terminal, the more tenuous our business is.”

There is an obvious appetite for waterfront cold storage, but when it will come together is an open question.

Americold Realty Trust, a global cold storage company, was selected in 2015 to build and operate the $30 million warehouse. At the time, Americold said it wanted to complete construction in 2017, but that construction plan was derailed by a rezoning process that lasted nearly two years and was fiercely opposed by some nearby residents concerned about the height of buildings and overdevelopment on that part of the waterfront.

Six months after winning the controversial zoning process, state authorities have found that the construction site will need to be stabilized before anything can be built on it.

Samples taken from the property this winter showed a deep layer of clay between infill soil and bedrock under the 6-acre industrial parcel that will not support a building, said Jedd Steinglass, a project manager with Woodard and Curran. Lots of new buildings, such as the downtown Wex headquarters, are built with pilings or other supports, he said. Because the western waterfront site has a history of large buildings, including a gasification plant, they thought the soil alone might support a warehouse.

“When we completed the work, it really is going to be necessary to have some ground improvement,” Steinglass said.

Americold also has yet to publicly commit to the project. The state has been in regular communication with the company, but has no contract to build and operate the facility or a lease for the state-owned land, said Nass, from the Maine DOT.

“What we are offering is a site that is prepared to build a warehouse on top of it. We purchased the land, cleaned it up environmentally. The final step is making it so we can put a structure there,” Nass said. “If they decide that this is not going to work for them, we believe there are plenty of other folks who can do this.”

Americold did not respond to an email last week asking if it was committed to a cold-storage building on the waterfront, or if challenges with the site would make it less likely to construct a new building there.

In a January email, public relations director Kim Henderson said Americold is “still working on a strategy for the Portland facility, so we cannot discuss details at this time,” but added that the company would respond when its plans were final. Americold operates a warehouse on Read Street in Portland.

In January, privately owned Americold went public, with an initial public offer aimed at raising $384 million. In its public filing, Americold identified a new development in New England and said it anticipated starting an average of two to three expansions or development opportunities per year, but it did not reference Portland or Maine specifically.

Nass said it was uncertain when plans for a final project might come out, but it would be completed eventually.

“What we are finding is that it is going to require some serious engineering,” Nass said. “It is 100 percent doable, it is just more complicated than we hoped.”

Peter McGuire can be contacted at 791-6325 or at:

pmcguire@pressherald.com

Twitter: PeteL_McGuire

Send questions/comments to the editors.