WASHINGTON — In just six seconds, the new ad from the Democratic Senatorial Campaign Committee previews an attack that will have millions of dollars behind it in 2018.

“The Republican tax scheme gives huge breaks to corporations, but raises taxes on middle class families,” says a narrator, as a woman checks her mailbox and recoils.

Democrats, routed but unified against the tax bill, plan to make it the centerpiece of a midterm campaign – one that may play out in a growing economy where the worst predictions about the tax cuts fall flat. Republicans, who once hoped that Democrats would feel pressured to back the bill, now suggest that voters will learn that the Democrats misled them.

“If we can’t sell this to the American people, we ought to go into another line of work,” Senate Majority Leader Mitch McConnell, R-Ky., said after the bill’s passage.

Republicans start that sales pitch from a surprisingly weak position. After months of rallies, presidential salesmanship, TV ads, and even a Republican National Committee door-to-door canvass, polling suggests that the bill is unpopular. In polls this week from CNN and NBC News, just 33 percent and 24 percent of voters said that they supported the bill.

The Republican response: Just wait. Millions of people now telling pollsters that the tax cut won’t help them will, in fact, pay lower taxes.

“When people see their paychecks get bigger in February because withholding tables have adjusted to reflect their tax cuts, when businesses are keeping more of what they earn, when they can write off their expenses and investments in their businesses and hire more people, that is going to change its popularity, I am convinced,” House Speaker Paul Ryan, R-Wis., said Wednesday on “CBS This Morning.”

Democrats are less convinced. One reason, frequently cited, is the payroll tax cut of 2009, which handed the average worker nearly $700 back during the Great Recession – with zero political benefit. In an early 2010 CBS News/New York Times poll, just 12 percent of voters realized that Obama had cut their taxes; twice as many thought, incorrectly, that Obama had raised them. (The cut was part of the 2009 stimulus package.)

These tax cuts, arriving during a period of economic growth, might be more noticeable. But Democrats are raring to point out the difference between what Republicans ran on, and what they passed. The most memorable visual symbol of the tax cut push, a hypothetical postcard to demonstrate the simplicity of the Republican tax plan, disappeared as Republicans put together a compromise that expanded the number of tax brackets and left many loopholes intact.

“Did they wave around that postcard today, or did they forget that?” joked Rep. Bill Pascrell, D-N.J., a member of the House Ways and Means Committee.

Democrats, he said, had endorsed previous tax plans with fewer (and lower) rates than the product that made it through the House and Senate. “Obama had it at 28 percent! Charlie Rangel and I had it at 25 percent 10 years ago. This bill is going to be the gift that keeps on giving.”

Republicans’ own polling has found the same weaknesses as public polling. In a study shared with The Washington Post, the Republican-leaning firm Public Opinion Strategies came up with four strong messages in favor of reform. Two of them – “removes and eliminates many loopholes so special interests start paying their fair share” and “simplifies and reduces taxes for most Americans by doubling the standard deduction” – are already being used to attack the bill.

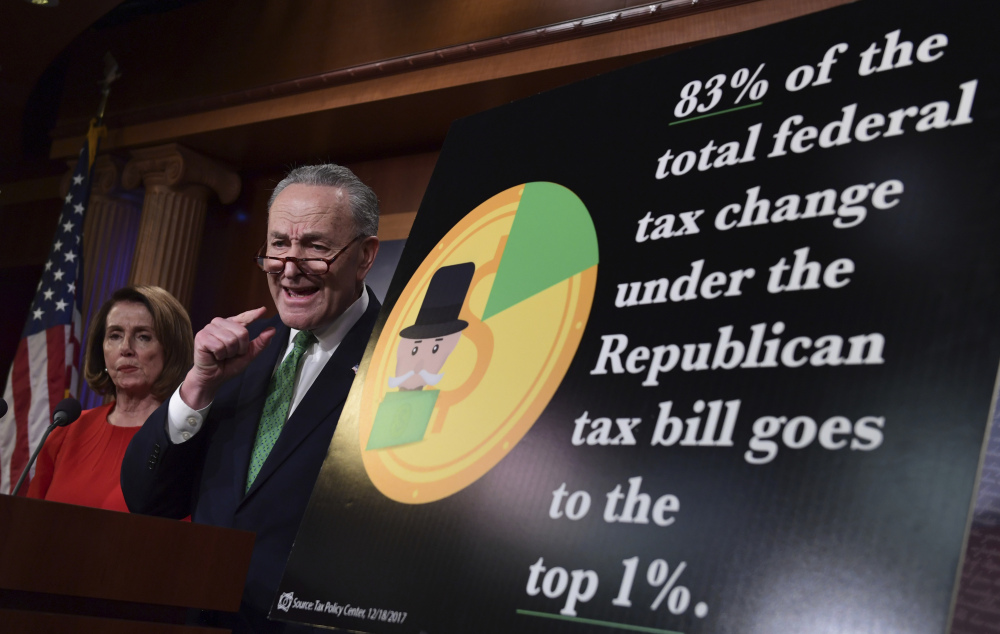

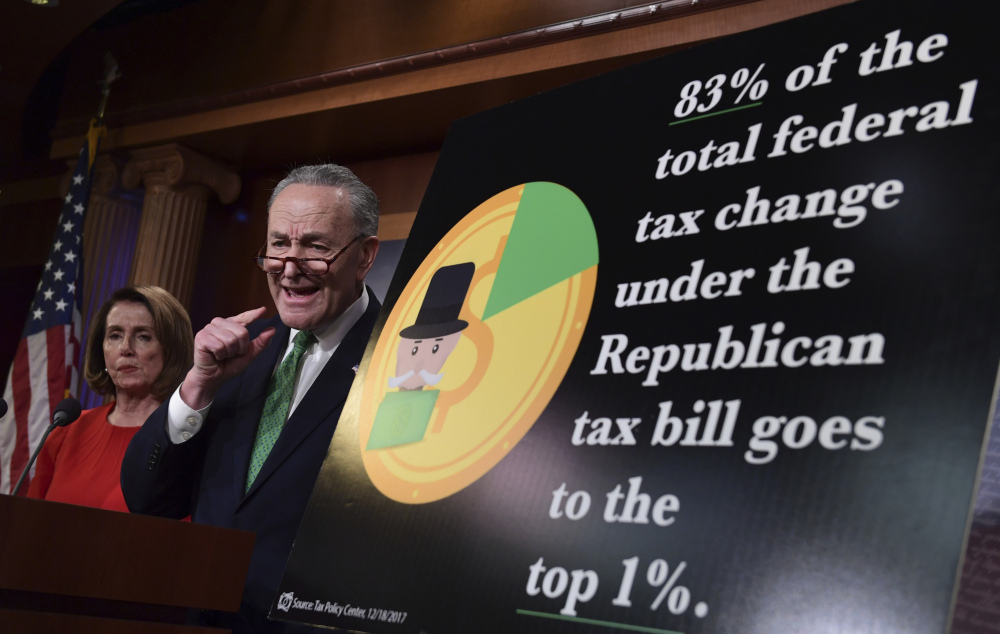

The idea of the bill as a corporate giveaway was key to Democrats’ final pre-vote messaging, including a moment in the Senate debate when Sen. Sherrod Brown, R-Ohio, flung upon one of the Senate’s doors and pointed to McConnell’s office to dramatize the influence of lobbyists.

It will also be a key part of a 2018 campaign by the #NotOnePenny coalition, formed by progressives to oppose the tax cut. Next year, the coalition will up its media buy from $5 million to $10 million, hold 100 days of anti-tax cut events, and rally on April 15 in Washington “against tax policy that further rigs the economy in favor of the wealthy.”

On Wednesday, Democrat after Democrat previewed those themes. Rep. Jacky Rosen, D-Nev., a candidate for Senate next year, released a video in which Medicaid and Social Security recipients worried that Republicans had put their care at risk. Jenny Wilson, a Salt Lake City council member running for Senate in Utah, dramatized the effects of the bill with “lumps of coal and well-stuffed stockings” to dramatize differing benefits for the poor and the very wealthy.

“Washington chose to cut taxes for millionaires and corporations and pay for it by cutting Medicare and kicking people off their health insurance,” said Brown, one of 10 Democrats seeking re-election next year in a Trump-won state. “It won’t stop there – congressional Republicans are already planning to steal the money Ohioans have paid into Medicare and Social Security to pay for the hole they are blowing in the deficit.”.

Send questions/comments to the editors.