NEWCASTLE — It seems unimaginable that just weeks after Equifax exposed to hackers the private data of 143 million people – nearly half of the U.S. population – that Congress would make it more difficult to hold big banks on Wall Street accountable, but that’s exactly what just happened in Washington.

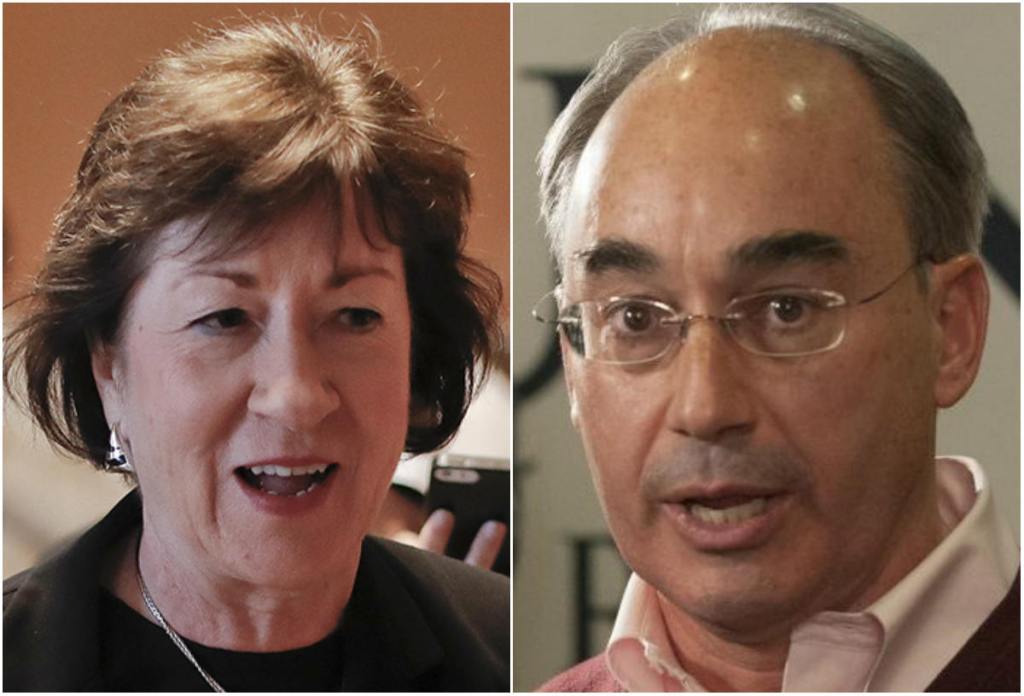

Last Tuesday night, after most people had gone to bed, U.S. Sen. Susan Collins cast the deciding vote on a bill that gave Wall Street its biggest victory since President Trump took office. And Susan Collins wasn’t the only Maine lawmaker to sell out Maine’s consumers to Wall Street. U.S. Rep. Bruce Poliquin supported the House version of the bill, too.

When I served as Maine’s public advocate for over 21 years, I stood up for Maine consumers and often went toe to toe with big corporations when they were skirting the rules. I expect our elected officials to do the same, but this time Sen. Collins and Rep. Poliquin gave Wall Street a free pass. Frankly, I was surprised that Sen. Collins went along with all her Republican colleagues this time. I had expected more of her.

Here was the issue last week. For years, big banks and credit card companies have put forced-arbitration clauses into the fine print of the contracts consumers must sign when they open a bank account or take out a credit card. And for years, forced arbitration clauses have blocked consumers from suing that bank or lender if they find out that they’ve been taken for a ride.

Instead, consumers who have been mistreated are forced into private arbitration, where the arbitrator is often chosen by the bank or lender. In the context of Equifax, that potentially represents 143 million individual arbitration cases, as opposed to one class-action suit. And since arbitrators often depend on the bank or lender for repeat business, it turns out they side with the bank or lender more than 90 percent of the time.

That was the problem the Consumer Financial Protection Bureau recognized when it created a rule restricting the use of forced-arbitration clauses – they realized the deck was stacked in favor of Wall Street, and against American consumers. As long as Wall Street is able to compel the use of arbitration clauses, consumers are prohibited from joining together in a class-action lawsuit and are prevented from having their case heard by a judge or a jury.

Sen. Collins and Rep. Poliquin voted to block that rule and to protect Wall Street’s use of forced-arbitration clauses. This paves the way for big banks like Wells Fargo to continue trampling on the rights of Maine’s consumers without fear of retribution. Indeed, when Wells Fargo was caught opening up 3.5 million unauthorized accounts for their customers, Wells Fargo used forced arbitration to shield itself from accountability, allowing the practice to continue for years – until it fell under the public spotlight.

It’s difficult to view Sen. Collins’ and Rep. Poliquin’s decision to choose Wall Street over the best interests of ordinary Americans as anything but a handout to Wall Street and the financial services industry. That industry has poured hundreds of thousands of dollars into the campaigns of each of these lawmakers over the years. In an era of unprecedented partisanship, it is worth noting that a majority of Democrats, independents and Republicans in Maine surveyed by Public Policy Polling came together to oppose Sen. Collins’ and Rep. Poliquin’s decision to block the rule, while only 11 percent of Mainers agreed with them.

The votes are a troubling indication of the influence Wall Street lobbyists can wield over our lawmakers. The legislation that Sen. Collins and Rep. Poliquin supported not only blocks this specific Consumer Financial Protection Bureau rule but also actually blocks the bureau from ever again issuing a similar rule in the future. We will now have to learn to live in a society where banks can operate with near immunity while consumers have next to no path for recourse.

As citizens of Maine, it’s our responsibility to ensure our representatives in Washington don’t succumb to pressure from loan shark lobbyists, that they don’t create more barriers for working families trying to get ahead and that they don’t sell us out to Wall Street ever again.

And if they do, it’s our job to hold them accountable at the ballot box.

Send questions/comments to the editors.