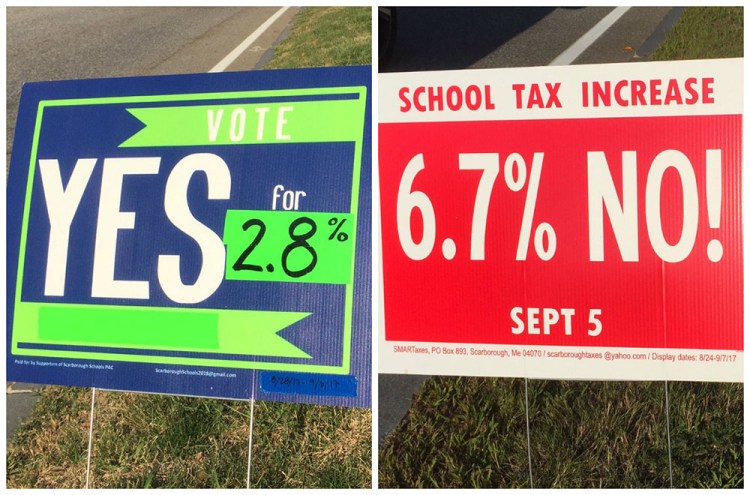

SCARBOROUGH — Brightly colored campaign signs lined up alongside Route 1 illustrate the deep divide and differing views that persist as town voters prepare for a third referendum Tuesday on the proposed 2017-18 school budget.

Signs calling for “yes” votes highlight a 2.8 percent increase in the gross school budget – which includes outside revenue sources in addition to tax revenue – from $45.8 million to $47.1 million. The latter number is the one voters will see in the ballot booth. It covers “essential programs and services” as defined by state law, and it excludes adult education and food services.

Signs pushing for “no” votes point out a 6.7 percent increase in the net school budget – which does not include outside revenue sources – from $39.8 million to $42.5 million. Opponents are focusing on spending that will be covered by local taxpayers, and they include additional costs for adult education and food services.

The gist of the budget dispute is this: Many who support the proposed school budget, which has been reduced slightly after each previous rejection, want local taxpayers to cover a $1.4 million loss in state education aid and avoid further cuts. Many who oppose the budget want the school district to cut spending rather than dip into cash reserves to cover the lost state aid.

“There’s a fundamental philosophical difference and I’m not sure there’s a way to bridge the gap,” Town Manager Tom Hall said Friday.

Budget opponents won’t say what number might satisfy them, “so we don’t know what it takes to get them to ‘yes,’ ” Hall said.

Hall informed the Town Council on Thursday that the tax rate for the fiscal year that started July 1 would be $16.49 per $1,000 in property value, if town voters approve the proposed school budget. That’s 57 cents or 3.6 percent higher than the $15.92 tax rate in fiscal 2017. Town officials had hoped that the town’s valuation would support a lower tax rate increase of 46 cents or 2.9 percent. At the higher rate, the annual tax bill on a $300,000 home would increase $171, from $4,776 to $4,947.

Tuesday’s referendum will take place at the Municipal Building, 259 Route 1, from 7 a.m. to 8 p.m. Many have already voted, however.

By Wednesday afternoon, Town Clerk Tody Justice had issued 1,610 absentee ballots and 1,385 had been returned. Early voting in the presence of an election official ended Thursday. Each referendum costs $2,500 to $3,000, Justice said.

This is the fifth time in 10 years that Scarborough voters have failed to approve a school budget on the first ballot. In the same period, the town’s education aid from the state has dropped by nearly $5 million, or 70 percent, from a high of $7 million in 2008-09 to $2.1 million in 2017-18 – largely because of its thriving commercial tax base.

Supporters say the proposed school budget is a good one developed under difficult circumstances. They point out that Scarborough’s per-pupil spending in 2015-16 was $353 to $1,843 lower than nearby communities such as Kennebunk, Falmouth, Yarmouth and South Portland.

Scarborough’s average starting teacher’s salary was $279 to $2,664 lower than those districts’, and its per-pupil administrative cost of $864 was less than half the state average of $1,888 and lower than 10 neighboring districts, said Superintendent Julie Kukenberger.

“I hope this budget passes,” said Councilor Will Rowan. “It’s a reasonable budget and I hope a majority of the community agrees with me.”

Fifty-seven percent of town voters – 2,408 to 1,822 – rejected the first school budget proposal on June 13. It was part of a combined $84.5 million operating budget for municipal, school and county services that would have increased overall spending by $2.5 million, or 3 percent.

On July 25, a slim majority of voters rejected a second proposal that cut $236,000 from the school budget and $71,000 from the municipal budget. The measure failed 1,930 to 1,847 – an 83-vote gap.

Town councilors unanimously approved an additional $50,000 reduction for the third referendum. It wasn’t enough for Steve Hanly, a leader of the “no” campaign and spokesman for SMARTaxes (Scarborough Maine Advocates for Reasonable Taxes).

“The $50,000 adjustment the Town Council made to the school budget was insignificant,” Hanly said an email. “It still results in taxpayers being asked to pay 6.7 percent more in school taxes than last year.”

The council also “has failed to recognize” that a 3 percent annual tax rate increase isn’t sustainable, Hanly said, especially after the school district this year drained its cash reserves to cover the state aid cut. Hanly didn’t answer a written question about how much of an increase would be acceptable.

Without a voter-approved school budget, state law allows the town and school district to operate under the council-approved spending plans.

“We must continue to work for and ultimately receive approval from the voters,” Hall said. “If we fail to win voter approval on Tuesday, we’ll need to get back at it again.”

Kelley Bouchard can be contacted at:

kbouchard@pressherald.com

Send questions/comments to the editors.