Gov. LePage’s biennial budget proposal is about what you would expect to see from someone who has been in office for six years.

Despite a few new wrinkles, like a new school funding formula (details to come) and a promise to overcome his bond phobia in order to pay for road repairs, the budget that was released late Friday evening promised a return to the unfinished battles of the last three legislative sessions, things the governor has wanted for a while but has not been able to get, often because of opposition he faced even inside his own party.

Think of this budget as a greatest hits package, not a new album.

And if the past is any indication, the budget proposal should not be considered an opening bid in a collaborative process. The governor has treated the last two biennial budgets as take-it-or-leave-it propositions and has not been interested in finding common ground. Both had to be passed over his veto.

So unless Gov. LePage has decided that the best way to get things done would be to change his way of doing things, we can expect him to do more heckling than bargaining as legislators try to craft a bipartisan spending plan that is capable of getting two-thirds support in both houses.

As they do, we hope that they will be more focused on the future and not just rehash the ideas of the past.

One nonstarter should be the governor’s pet solution to all problems – cutting taxes on millionaires in the hope that they will generate economic growth.

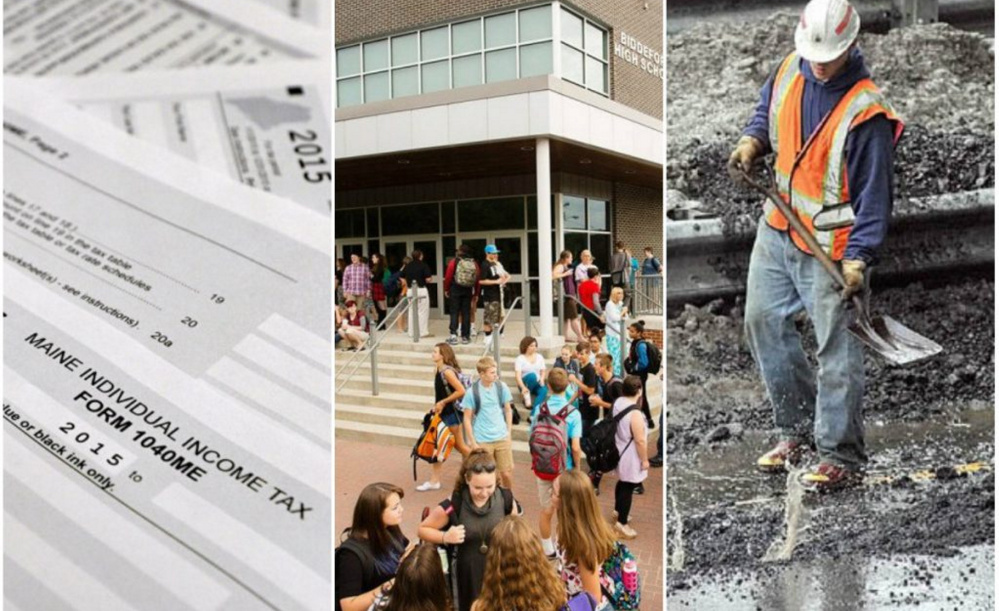

LePage pushed through significant income tax cuts in his first budget, and the results are in: While the entire country rebounded from the Great Recession, Maine was one of only seven states that did not recover the number of jobs that it had lost when the national economy crashed. Maine had the worst job growth in New England despite having one of the lowest tax rates. Lower taxes did not deliver superior economic growth in comparison with other states that did not raise taxes.

LePage’s tax policy did have an effect: By reducing the ability of the state to meet its responsibilities, it put more pressure on communities and school districts, who in turn put more pressure on property tax payers.

In order to pay for tax cuts like the elimination of the levy on estates valued at more than $5 million, LePage is proposing even deeper cuts to programs for poor families, including eliminating health insurance for parents of kids who qualify for MaineCare. And he wants to eliminate state support for General Assistance, the last resort for the poorest of the poor.

The state is a different place than it was in 2011, when Gov. LePage came to office.

Our population is older and sicker than it was then, and many of the manufacturing companies that anchored communities are gone for good.

The 2017-2018 budget should be looking ahead to find ways to get new businesses to start up and grow, attracting and retaining young people who want to live here and start families.

It should at the very least present a plan for investing in education and human services so that every child has enough to eat and a secure place to live.

Maine can’t afford to spend another two years refighting the same six-year-old battles. Democrats and Republicans in the House and Senate should find a way to look ahead, with the governor’s participation or without it.

Send questions/comments to the editors.