Recent mill closures and layoffs may have reduced the pulp and paper industry’s economic impact in Maine, but there are still significant investments being made in the state’s mills.

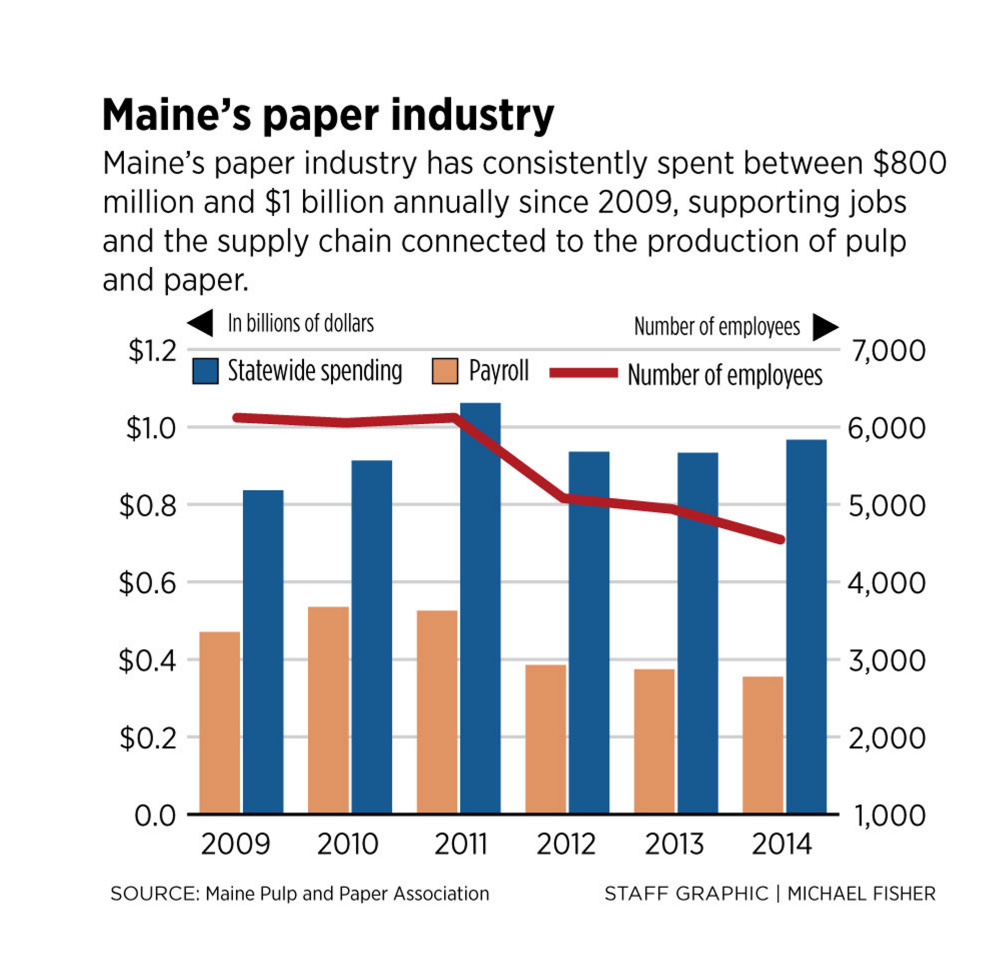

The pulp and paper industry employed 4,532 people in 2014, according to figures released Tuesday by the Maine Pulp and Paper Association, based on a survey of all Maine mills. That’s a 25 percent reduction from 6,039 employees in 2010. During the same period, total payroll at Maine mills fell from $534 million to $354 million.

But investments in the industry’s infrastructure remain strong, an indication that the state’s remaining paper companies are committed for the long term.

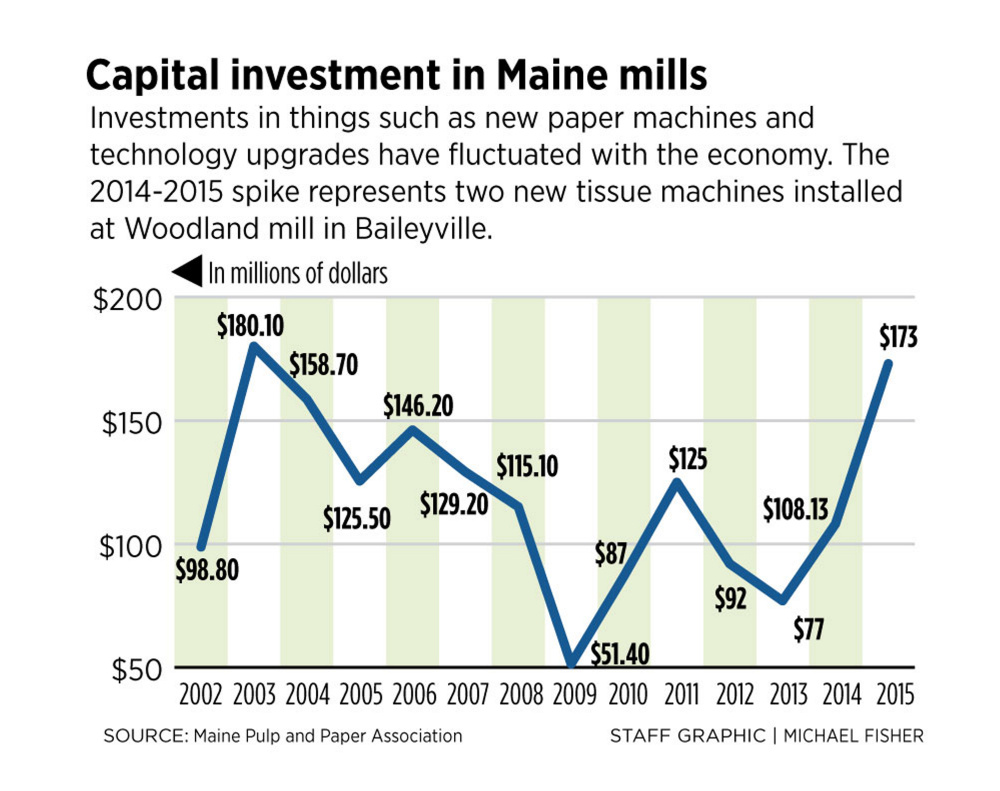

Maine mills are expected to invest $173 million in their mills this year, according to the survey, an increase from $108 million in 2014 and the largest amount since 2003 when capital investment reached $180 million.

The majority of that investment is likely a result of the installation of two new tissue machines at the Woodland mill in Baileyville. However, money has been put into other mills, including at the Twin Rivers mill in Madawaska and at Sappi’s Somerset mill in Skowhegan, said Donna Cassese, managing director of wood supply for Sappi’s mills in Maine and Minnesota and board chair of the Maine Pulp and Paper Association.

But she cautioned not to read too much into the figures. Spending in the paper industry can be cyclical, Cassese said. Especially in the wake of the recession, there may be pent-up demand for facility upgrades that are still getting worked out. A few significant capital expenditure projects at a few mills can create a spike in the numbers.

“Some of the spending is cyclical, but overall what those numbers say is there’s significant amounts of money spent in the state of Maine,” Cassese said.

The investments are among the few bright spots in an industry that has been rocked by layoffs and closures in the past two years because of high energy costs, falling demand due to changing consumer behavior and increased foreign imports. Great Northern Paper Co. stopped production at its East Millinocket mill in February 2014 with the loss of 212 jobs, followed by the closure of Verso Corp.’s mill in Bucksport and the loss of its roughly 500 jobs.

The bad news continued this year, with Verso announcing in August that it would lay off 300 at its mill in Jay. And in a double whammy during a two-day period in late September, Lincoln Paper and Tissue, which employs 170, announced it was filing for bankruptcy, and Expera Specialty Solutions announced it would close its Old Town pulp mill by the end of the year, leaving 195 without jobs.

The paper association survey, which had 100 percent participation from the nine remaining Maine pulp and paper mills, was circulated in early 2015, so the 2014 figures take into account the closures of the East Millinocket and Bucksport mills.

Most of the job losses reflected in the survey data are a result of the mill closures, but there also are job losses as the industry invests in modernization initiatives that make the mills more efficient, Cassese said.

“Any industry you look at it is going to become more efficient and spend capital to reduce fixed costs as part of modernization efforts,” she said.

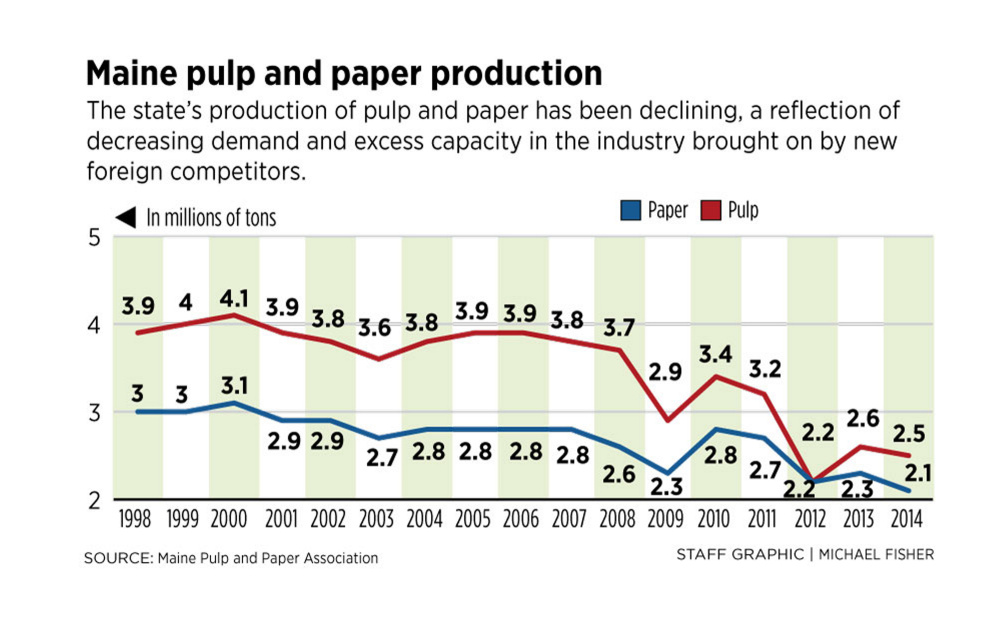

As a result of the closures, the amount of paper being manufactured in Maine also has fallen. Maine’s mills reported producing 2.5 million tons of paper in 2014, down 35 percent from the 3.9 million tons reported to be produced in 1998, according to the survey. Pulp production also fell in the same period, from 3 million dry tons to roughly 2.1 million dry tons.

The survey results were released at a summit convened by the paper association to bring together roughly 250 stakeholders in the industry, from paper mill employees to loggers to legislators. They discussed the industry, its challenges and its future.

An oft-repeated message at the full-day conference was that despite the headlines, the industry is still strong. A point of fact: The average papermaking job pays $70,883 a year, and because of retiring workers there are expected to be continued openings. Also, spending by Maine mills on logs and other supplies from Maine increased from $912 million in 2010 to $965 million in 2014, according to the survey.

Amanda Rector, Maine’s state economist, underscored the vitality of the industry in her address at the summit.

Pulp and paper is still Maine’s top manufacturing sector, contributing 15.7 percent of Maine’s total manufacturing gross domestic product in 2013, which totaled about $5 billion, Rector said. It’s also Maine’s top export, valued at slightly less than $500 million in 2014. By comparison, Maine lobster exports were valued at $349 million.

The total economic impact of Maine’s pulp and paper industry is not really known, however. The state has not done a formal economic analysis of the industry in a very long time, Rector said.

The last analysis “is old enough that I can’t even lay hands on it,” she said.

The pulp and paper association cites a figure from the Maine Forest Products Council that says Maine’s forest economy has an $8 billion economic impact. But that figure is several years old and does not reflect the impact of recent mill closures.

Rector said the impact of the paper industry ripples throughout the economy, well beyond the value of the products sold and wages paid.

“It’s also a fact that logging jobs are being supported by the pulp and paper side of it, and there’s a lot of trucking and transportation jobs related to it,” she said. ” So you have other industries very closely tied to this one that also have workers they’re paying wages to and that are being spent in their communities.”

Cassese said Tuesday’s summit, the first the association has held, was a good opportunity to bring together various people and begin to set an agenda for the challenges to be tackled first, whether it’s energy policy in Augusta or wood supply. While much of the good news is eclipsed by the negative headlines, there is still a robust industry in Maine.

“Don’t close the door on us,” Cassese said. “We’re still in it and we’re still hiring and we want that message to get out.”

Send questions/comments to the editors.