A giant Dutch operator of supermarket chains in the United States and Europe has agreed to buy the Belgium-based parent company of Hannaford, the largest supermarket brand in Maine.

If approved by regulators and shareholders, the merger would create one of the world’s largest supermarket conglomerates, worth about $29 billion, and produce significant cost savings for both companies, retail analysts said.

Royal Ahold, which is based in the Netherlands and owns the Stop & Shop chain in New England, plans to absorb Hannaford’s parent, Delhaize Group, by paying its shareholders about $10 billion in Ahold stock. The deal is expected to close in mid-2016.

The new company would be the fourth-largest supermarket conglomerate in the U.S., with a market share of about 5 percent. The merger isn’t likely to result in a name change for Hannaford, or a shift away from the supermarket’s focus on local customers and suppliers, Hannaford spokesman Eric Blom said via email.

“It is important to note that Ahold and Delhaize have highly complementary geographic footprints and that the merged company would continue to operate strong, local banners,” he said. “Customers value local brands and local associates who serve them.”

Blom said the merger would benefit Hannaford shoppers by opening up access to store-branded goods from both companies’ U.S. chains.

“Hannaford would be able to offer an expanded range of high-quality goods and services at competitive prices, with an even broader selection of private-brand products,” he said.

COMBINED SALES OF $54.1 BILLION

The two companies described the deal as “a merger of equals,” but all Delhaize stock would be converted to shares in Ahold, which is nearly twice as large as Delhaize.

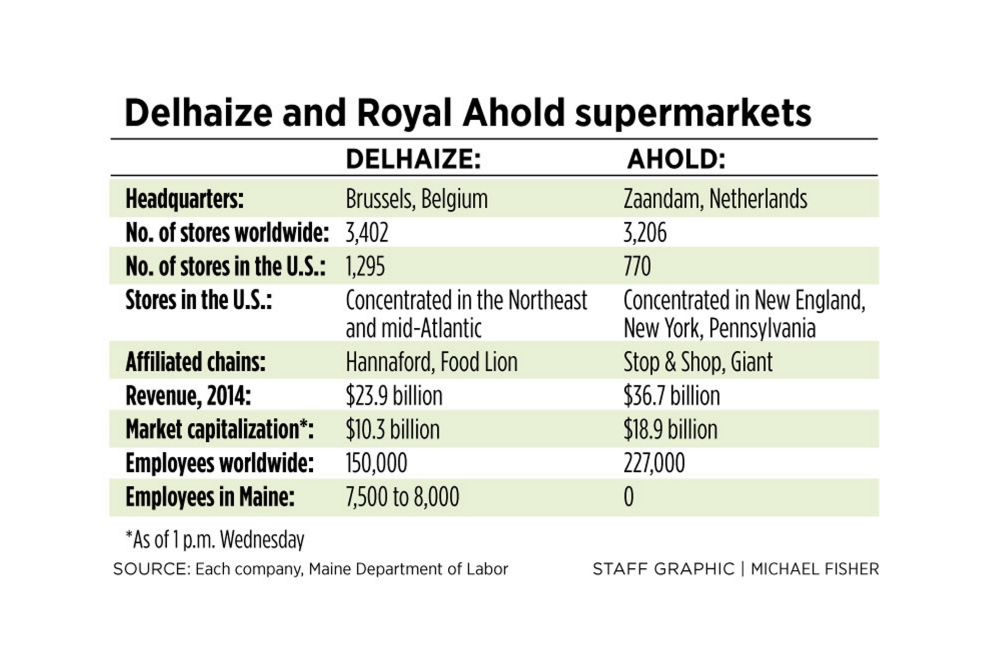

Once combined, the company would have more than 6,500 stores and about 375,000 employees in the U.S. and Europe. Last year, the two had combined sales of $54.1 billion.

Delhaize bought Hannaford, which has 186 stores in the Northeast, in 1999. The Hannaford division has largely operated independently since that purchase, with a large headquarters and distribution center in Scarborough.

Hannaford has about 26,000 employees throughout the chain and is Maine’s largest private employer, with 7,500 to 8,000 workers in the state.

In addition to Hannaford, Delhaize owns Food Lion in the U.S., a chain based primarily in the Southeast. Ahold’s U.S. holdings include the Stop & Shop chain in New England; the Giant chain, primarily in the mid-Atlantic; and online grocery service Peapod.

There is no overlap in Maine between the chains owned by Delhaize and Ahold, and very little throughout the East Coast, which analysts said would make it easier for the merger to sidestep antitrust concerns and the closure of a significant number of stores.

Ahold doesn’t operate stores in Maine or New Hampshire. Both companies have stores in Massachusetts, but Blom said it is “premature to speculate about specifics” regarding whether any overlapping stores would be closed.

The companies did not disclose how the merger would affect each individual chain. For instance, it isn’t known whether Hannaford stores would be converted to Stop & Shop stores, or vice versa. However, both companies’ CEOs have told analysts that there would be limited benefits to consolidating existing brands.

HANNAFORD OUTRANKS STOP & SHOP

In the May issue of Consumer Reports, which focused on supermarkets, Hannaford scored higher than Stop & Shop in every category, including the quality of its produce, meat and poultry, bakery and store-prepared food. Hannaford’s store staff and cleanliness also received higher ratings than Stop & Shop’s.

Overall, Hannaford ranked No. 21 on the magazine’s list of the country’s best supermarket chains, while Stop & Shop ranked No. 60.

According to consumer surveys by the Washington, D.C.-based nonprofit Center for the Study of Services, Hannaford stores are seen as smaller and less expensive than Stop & Shop stores.

Still, Stop & Shop is generally well-liked by its customers, said Jon Springer, retail and whole health editor at industry publication Supermarket News. It is generally seen as a reliable, no-nonsense supermarket with a wide selection of items, he said.

European companies such as Delhaize and Ahold have a reputation for not messing with established brands after buying them, Springer said, which means Hannaford customers aren’t likely to be shopping at a Stop & Shop anytime soon.

“I don’t think they’re going to spend a whole lot of time and money converting Hannaford into Stop & Shop,” he said.

Stock analysts praised the announcement Wednesday, saying the merger would benefit shareholders by lowering overhead costs and increasing the combined company’s purchase power in Europe and the U.S.

POTENTIAL SAVINGS OF $550 MILLION

Analyst Pim Keulen of investor website Seeking Alpha said the merger is a logical move for both companies and should boost profits by lowering operating expenses.

“From a geographic and strategic point of view, the merger between Ahold and Delhaize makes perfect sense,” Keulen wrote in his analysis. “The combination will have a very strong presence in the entire East of the United States and will be market leader in both the Netherlands and Belgium.”

Synergies created by the deal would save the combined company about 500 million euros – or $550 million – annually within three years, the companies said.

Ahold has a market capitalization of roughly $19 billion, compared with about $10 billion for Delhaize, according to company share prices Wednesday afternoon.

The U.S. supermarket industry is highly fragmented, but has been undergoing consolidation. In January, Idaho-based Albertsons acquired California-based Safeway in a deal valued at $9.2 billion, making it the third-largest U.S. supermarket chain after Walmart, based in Arkansas, and Cincinnati-based Kroger.

Upon completion of the deal, Ahold CEO Dick Boer would become the combined company’s CEO, and Delhaize CEO Frans Muller would become deputy CEO and chief integration officer.

Delhaize shareholders would receive 4.75 Ahold shares for each Delhaize share, the companies said. Ahold shareholders would own 61 percent of the combined company’s equity, and Delhaize shareholders would own 39 percent.

Send questions/comments to the editors.