AUGUSTA — Gov. Paul LePage presented a $6.3 billion budget Friday that proposes cutting income taxes and eliminating the estate tax, and partially paying for both measures with a broader and higher sales tax.

The governor also is proposing significant changes to the welfare reimbursement formula that could mean the loss of millions of dollars for a number of communities, especially Portland.

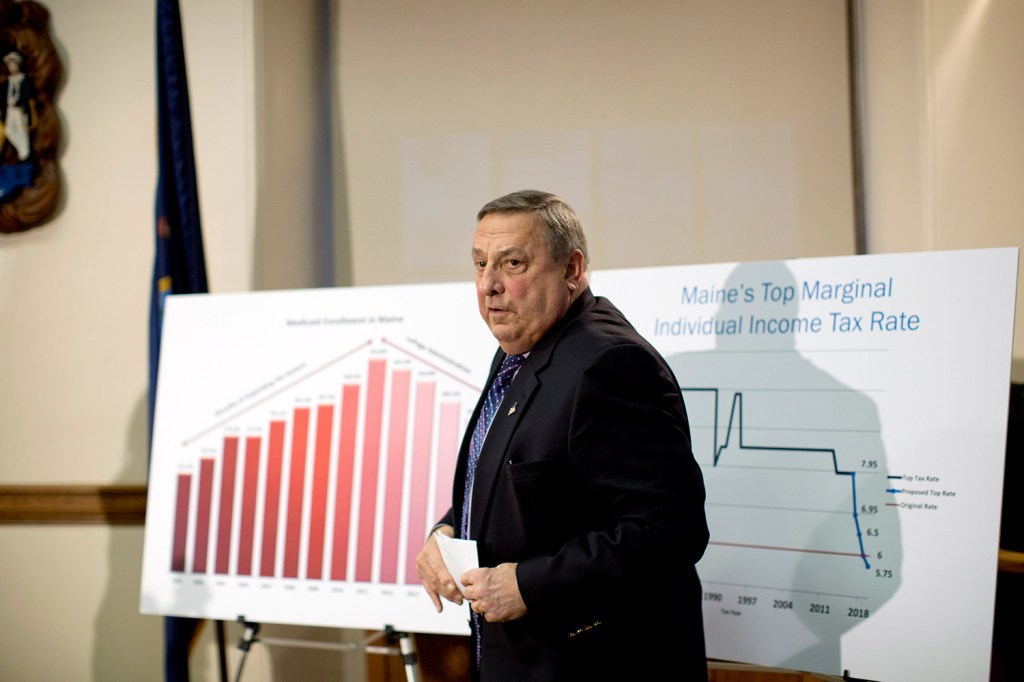

The two-year proposal is similar in concept to a tax reform proposal that the Legislature passed in 2009, but voters overturned in 2010 through a ballot measure pushed by Republicans. The proposal would reduce the top income tax rate from 7.95 percent to 5.75 percent. The top rate presently applies to many taxpayers, including, for example, a single person earning more than $21,200.

LePage’s plan would raise the income threshold for applying the top rate, from $21,200 for single tax filers to those with incomes over $50,000. All told, the array of changes would result in a $1.2 billion cut in individual income taxes through the fiscal year beginning 2018.

The income tax changes would be paid for with increases in the sales tax, eliminating exemptions and the eventual elimination of state aid to municipalities, a cut that would result in the loss of approximately $164 million a year to Maine’s 450 cities and towns. The budget attempts to ease the blow by giving towns more authority to tax large nonprofits – an initiative that state lawmakers have contemplated at least seven times over the past 35 years, but never implemented.

The budget would increase the sales tax from 5.50 percent to 6.5 percent. While Democrats are expected to object to a number of provisions in the budget, Republican lawmakers could also find themselves caught between their record of opposition to sales tax increases and a governor who believes he has a mandate from voters.

TAX CODE

The administration claimed the budget will result in a $300 million reduction in tax liability for Mainers, while modernizing the tax code with a shift from a reliance on income taxes to sales, or consumption, taxes.

“During my first term, we took the first step toward significant tax relief,” LePage said. “In this budget proposal we are modernizing Maine’s out-of-date tax code to make Maine more competitive with other states.”

He added, “This budget is moving toward an efficient, effective and affordable government for the state of Maine. We want to become a competitive economy. We want to become a prosperous economy.”

The proposal would broaden the sales tax by eliminating an array of exemptions, including those on recreational activities, such as golfing.

“Everyone has to pay their fair share,” LePage said. “If you love to play golf, which I like to do, you’re going to pay more.”

Similar attempts to eliminate exemptions have generated opposition from affected interest groups. That includes LePage’s plan in 2013 to eliminate a business equipment tax rebate program. The governor’s proposal takes aim at the program again, but this time would employ a gradual phaseout.

The budget also would eliminate the income tax on pensions, and would expand the homestead tax exemption for retirees – a proposal that reinforces an initiative previously advanced by Democratic House Speaker Mark Eves of North Berwick.

In addition, Mainers could be eligible for tax credits to offset the increased sales tax.

The budget contains $46 million to reduce Medicaid waiting lists for the disabled and elderly. Another $22 million is allocated to nursing homes.

Health and Human Services Commissioner Mary Mayhew said the administration’s steps to rein in Medicaid costs are enabling the state to shift resources toward vulnerable populations.

“These initiatives are finally possible,” Mayhew said. “No longer are we swimming in a sea of red ink.”

GENERAL ASSISTANCE

In a change that would have significant financial implications for Portland, the LePage administration wants to change the formula for reimbursing municipalities for General Assistance paid to help needy individuals or families pay for rent, utilities or other basic needs.

Currently, the state reimburses towns for at least 50 percent of General Assistance expenditures but pays as much as 90 percent to larger cities. The administration’s budget seeks to flip the formula by reimbursing municipalities for 90 percent of GA payouts initially but then only 10 percent once a locality “reaches 40 percent of the six-year GA spending average.”

Mayhew said the proposal would end what is now a “perverse incentive” for municipalities to overspend on GA.

It was unclear Friday exactly how the change would affect Portland, but LePage made clear that the switch-up is primarily aimed at Maine’s largest city, which he called “an outlier” because of its large GA budget. The city expected to give out nearly $11 million in GA last year, with the state reimbursing roughly $9 million of that total.

“So what I’m saying is … here is the 90 percent, use it wisely,” LePage said. “If you choose not to use it wisely, you will hit the (threshold) faster than the other communities. And then you have to make a decision: How generous is generous? I think there is so much we can afford and so much we cannot.”

Portland Mayor Michael Brennan said the General Assistance changes and proposed cuts in municipal revenue sharing were “disappointing but not unexpected” given past budgets. Brennan had not yet seen the proposal and said he could not speculate on the costs to Portland.

Brennan said the reality is that there are people living in Portland who need assistance.

“Just because the governor decides they shouldn’t (receive help), they don’t evaporate or go away,” Brennan said. “There are still services that need to be provided and this is just another way of shifting resources from the state to municipalities and to property taxes.”

The LePage administration has been embroiled in a months-long legal fight with Portland, Westbrook and the Maine Municipal Association over a decision to stop reimbursing communities for General Assistance provided to asylum seekers and other immigrants who have not yet gained legal residency status.

In another proposed welfare reform, LePage wants to eliminate General Assistance, food stamps and Temporary Assistance for Needy Families, or TANF, provided to “legal non-citizens.” This group would appear to include immigrants granted asylum as well as those living in the United States with valid visas.

Mayhew said the change would bring Maine into compliance with federal requirements, while freeing up money for other programs.

“Those are changes that have been in front of the Legislature multiple times,” Mayhew said. “This budget is about setting the table and asking the Legislature to truly prioritize how we need to most effectively support services for our elderly, our disabled, people with mental illness and investing in good support for our health care system.”

The budget would flat-fund municipal revenue sharing in the fiscal year beginning July 1, but eliminate it in the following fiscal year. The administration said the budget would ease the blow of cutting revenue sharing by giving municipalities more authority to collect property taxes from large nonprofits, such as hospitals or colleges, which are presently tax-exempt. Only nonprofits with property values of $500,000 or more would be subject to this new local taxing authority.

According to the Tax Foundation, the nonprofit tax change would generate $60 million in annual revenue to towns and cities. However, it’s unclear how towns without a qualifying nonprofit would absorb the loss in municipal revenue sharing.

LENGTHY NEGOTIATIONS TO COME

Democrats were caught off guard by the governor’s plan to broaden and raise the sales tax. Eves, the House Speaker, was asked if he thought LePage would ever propose a sales tax increase.

“Never,” he said.

Still, Eves said, there was a lot to digest.

“It’s really good to see some of the bigger pieces of the governor’s proposal,” he said. “It’s a good start and I think there are things in here we can agree with. There are things that we are concerned about and need to learn a whole lot more.”

Republicans, some of whom could be contemplating tax changes that they once vociferously opposed, applauded the governor for a bold proposal.

Senate President Michael Thibodeau said the budget was an “outside-the-box approach to driving our economy and making Maine more competitive.”

Sen. Roger Katz, R-Augusta, a member of the budget writing committee, said, “Good for him for trying to change our antiquated tax system. Ask anyone around here if they think the current system is working and they’ll tell you, no.”

Others were wary of the proposal.

Garrett Martin, director of the progressive Maine Center for Economic Policy, said the proposal was “a failed prescription for growing Maine’s economy.”

“The tax cuts contained in the governor’s budget proposal will benefit the wealthy and corporations, while raising sales and property taxes for the rest of us,” Martin said in a statement. “They will also trigger harmful cuts in health care for children, the elderly, and the disabled, delay essential repairs to our crumbling roads and bridges, and undercut a good education for our kids.”

The governor’s budget proposal marks the beginning of a long legislative process that typically doesn’t end until the final weeks of the legislative session in June. The budget bill, once printed and referenced to the budget committee by the House and Senate, will become a legislative document that will be negotiated and likely changed before facing votes by the full Legislature and going back to LePage for approval.

The negotiations will take place on the budget committee and between the leaders in the Republican-controlled Senate and the Democrat-controlled House. The power dynamic likely means that both sides will stake out strong positions to start before working toward a compromise. A failure to reach an accord before the start of the fiscal year beginning July 1 could result in a shutdown of state government.

The governor acknowledged that the budget would be a long negotiation. However, he refused to say which provisions were most important to him.

“We’re not going to negotiate today, boys,” he said.

Correction: This story was updated at 11:40 a.m. on Jan. 12, 2015, to correct Maine’s sales tax.

Send questions/comments to the editors.