A 25-year-old single person living in Portland and earning $25,000 would pay about $150 per month – after a federal subsidy – to buy one of the plans on Maine’s new health care exchange, according to one insurance provider.

A 50-year-old single smoker living in Lewiston and earning the same annual salary would pay $369 per month after the subsidy for the same plan.

In both cases, the policy holders would have to spend $5,000 of their own money for most health services before the insurance carrier starts covering the costs.

A full-scale analysis of newly released insurance rates available through Maine’s exchange is not yet possible because information about the plans being offered is incomplete. However, one insurer — Maine Community Health Options co-op — released a few examples of plan costs and benefits to the Press Herald on Thursday, offering a first glimpse of the costs and coverage.

Maine Community Health Options and Anthem Blue Cross Blue Shield are the two insurance providers offering plans on the exchange. The two submitted proposed rates to the state Bureau of Insurance that were released Wednesday. Those rates will go before the federal government for final approval.

Wednesday’s filing was for regulatory purposes and did not include information for consumers, but they will be able to do comparison shopping for insurance in the coming weeks on www.healthcare.gov, officials said.

Individuals — typically the self-employed or those currently without health coverage now — can start purchasing insurance on the exchange on Oct. 1, with coverage taking effect on Jan. 1. This is one of the main components of the Affordable Care Act.

Those who don’t buy insurance will be forced to pay a penalty. Less than 10 percent of the overall insurance market will be purchasing insurance on the exchange, according to the Maine Bureau of Insurance, with most others covered by Medicaid or employer insurance plans.

How the new plans compare with those available on the open market now is difficult to determine, and Kevin Lewis, CEO of Maine Community Health Options, said he didn’t even try. “It would probably take an army of actuaries to figure that out,” Lewis said.

He said in many ways it’s irrelevant, because the high-deductible plans on the existing individual market are so different from what is required of plans under the Affordable Care Act that the comparisons would be meaningless.

“We just tried to offer the best product that we could at the best price, within the framework of the Affordable Care Act,” Lewis said.

An Anthem spokesman did not respond to a request for information Thursday.

Lewis provided a few scenarios, including examples of what are known as “Bronze”-level plans to be offered by Maine Community Health Options. The “Bronze” plans feature lower premiums but less generous benefits than “Silver” and “Gold” plans offered on the exchange.

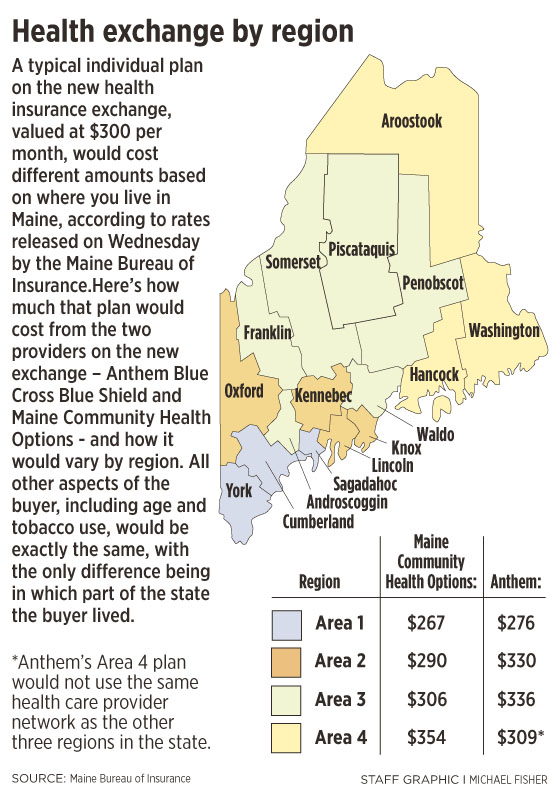

Premiums will vary depending on factors such as the policyholder’s age, whether they smoke and where in the state they live. Premiums will be higher in more rural, northern areas of the state, for example.

In one other example, a family of four in Bangor with a $40,000 annual income would pay about $165 per month for a “Bronze” plan, and would have a $10,000 deductible, according to the information about Maine Community Health Options plans. For this family, a $700 subsidy would cover most of the $865-a-month premium because of their low income.

Subsidy amounts for the family and other examples are based on the Kaiser Family Foundation website at kff.org/health-reform.

The subsidies will be available on a sliding scale for those earning between 100 percent and 400 percent of the federal poverty level, and subsidies to reduce out-of-pocket costs for deductibles, co-pays and other costs will also be available to those earning 100 percent to 250 percent of the federal poverty line.

Plans are also required to cap out-of-pocket costs per year, at $6,350 for many plans.

Trish Riley, a senior fellow with the Muskie School of Public Service at the University of Southern Maine, said that, in general, the plans sold to individuals and families now offer lower benefits and have higher deductibles than those to be offered on the exchange.

“It (the Affordable Care Act) has better protection for the consumers, and better benefits,” said Riley, former director of the Governor’s Office of Health Policy and Finance under Gov. John Baldacci.

Lewis said the co-op, which was formed with a federal loan, is trying to lower health care costs by offering services that should help reduce costly hospital visits. For instance, those with chronic illnesses such as asthma, diabetes and hypertension will receive generic drugs at no cost, Lewis said.

Joe Lawlor can be contacted at 791-6376 or at:

jlawlor@pressherald.com

Twitter: @joelawlorph

Send questions/comments to the editors.