WASHINGTON — You’d think health insurance CEOs would be chilling the bubbly with Republican Mitt Romney’s improved election prospects, but instead they’re in a quandary.

Although the industry hates parts of President Barack Obama’s health care law, major outfits such as UnitedHealth Group and BlueCross Blue Shield also stand to rake in billions of dollars from new customers who’ll get health insurance under the law. The companies already have invested tens of millions to carry it out.

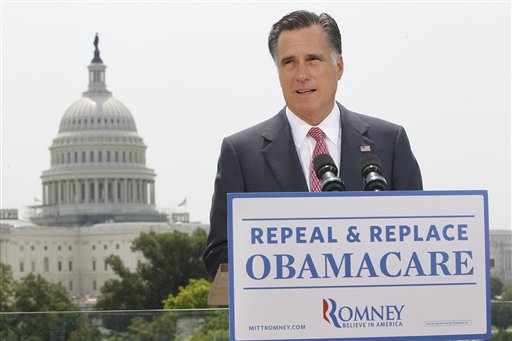

Were Romney elected, insurers would be in for months of uncertainty as his administration gets used to Washington and tries to make good on his promise repeal Obama’s law. Simultaneously, federal and state bureaucrats and the health care industry would face a rush of legal deadlines for putting into place the major pieces of what Republicans deride as “Obamacare.”

Would they follow the law on the books or the one in the works? What would federal courts tell them to do?

The answers probably would hinge on an always unwieldy Congress.

Things could get grim for the industry if Republicans succeed in repealing the Affordable Care Act’s subsidies and mandates, but leave standing its requirement that insurers cover people with health problems. If that’s the outcome, the industry fears people literally could get health insurance on the way to the emergency room, and that would drive up premiums.

“There are a lot of dollars and a lot of staff time that’s been put into place to make this thing operational,” G. William Hoagland, until recently a Cigna vice president, said of the health care law.

Insurers “are not going to be out there saying, ‘Repeal, repeal, repeal,'” said Hoagland, who oversaw public policy at the health insurance company. “They will probably try to find the particular provisions that cause them heartburn, but not throw the baby out with the bath water.”

The Romney campaign isn’t laying out specifics on how the candidate would carry out his repeal promise, other than to say the push would begin on his first day in office. Romney has hinted that he wants to help people with medical conditions, doesn’t say what parts of the health care law he’d keep.

Likewise, America’s Health Insurance Plans, the major industry trade group, isn’t talking about what its members are telling the Romney campaign, though informal discussions are under way through intermediaries. Insurers like Romney’s plan to privatize Medicare, and some point out that it looks a lot like Obama’s approach to covering the uninsured.

Robert Laszewski, an industry consultant and blogger, says the tension is becoming unbearable.

“I spend a lot of time in executive offices and board rooms, and they are good Republicans who would like to see Romney win,” said Laszewski. “But they are scared to death about what he’s going to do.”

There is no consensus among Republicans in Congress on how to replace Obama’s law, much less anything like a bipartisan middle ground on health care, a necessity if the House retains its GOP majority and the Senate remains in Democratic hands.

In contrast, Obama’s law is starting to look more and more like a tangible business opportunity. In a little over a year, some 30 million uninsured people will start getting coverage through a mix of subsidized private insurance for middle-class households and expanded Medicaid for low-income people. Many of the new Medicaid recipients would get signed up in commercial managed care companies.

A recent PricewaterhouseCoopers study estimated the new markets would be worth $50 billion to $60 billion in premiums in 2014, and as much as $230 billion annually within seven years.

Under the law, insurance companies would have to accept all applicants, including the sick. But the companies also would have a steady stream of younger, healthier customers required to buy their products, with the aid of new government subsidies. That finally could bring stability to the individual and small-business insurance markets.

At a time when employer coverage has been eroding, government programs such as Medicare, Medicaid, and now Obama’s law are becoming the growth engines for the industry’s bottom line. The trend seems too big to derail, says Morningstar analyst Matthew Coffina, who tracks the health insurance industry.

“I think it’s limited what they’ll be able to accomplish in terms of repeal,” said Coffina. “We have to remember that Romney implemented very similar legislation” as governor of Massachusetts.

If Romney wins he’s more likely to reduce the scope and scale of the law, Coffina added. Possibilities include delaying all or parts of the new coverage, particularly a Medicaid expansion that GOP governors don’t like.

The industry has three items in particular it wants stripped out: cuts to Medicare Advantage private insurance plans; a requirement that insurers spend 80 percent of premiums on medical care or rebate the difference to their customers; and new taxes on insurance companies. But CEOs don’t share the visceral objection that many Republicans have to a bigger government role in health care.

Industry executives “are Republicans in the sense that they’re worried about the bottom line and they want to retain private sector involvement,” said Hoagland, the former Cigna vice president. “But some of their bottom line is now driven by Medicare and Medicaid. So it’s not like they’re red or blue. It’s more like purple.”

Send questions/comments to the editors.