CHICAGO – Clergy seem an unlikely group to be facing a retirement security crisis.

They generally are looked up to by their parishioners as wise and frugal. Their pay, although modest, is enough to get by on. And they typically are provided with housing during their careers.

Yet many find themselves in a financial quandary as they approach or reach retirement, squeezed by challenges that sometimes exceed those of other professionals. Often lacking home equity and a pension, some are struggling to get by and others are staying on the job longer.

The root of the problem is not just limited pay or retirement compensation, according to the Rev. Dr. Bert White, a retired Methodist clergyman and lecturer at Boston University. It’s a lack of financial literacy among people who really need to take control of their personal finances or risk ending up in dire straits.

“Clergy are so focused on the hereafter, but we should know more about planning for life after work,” White says.

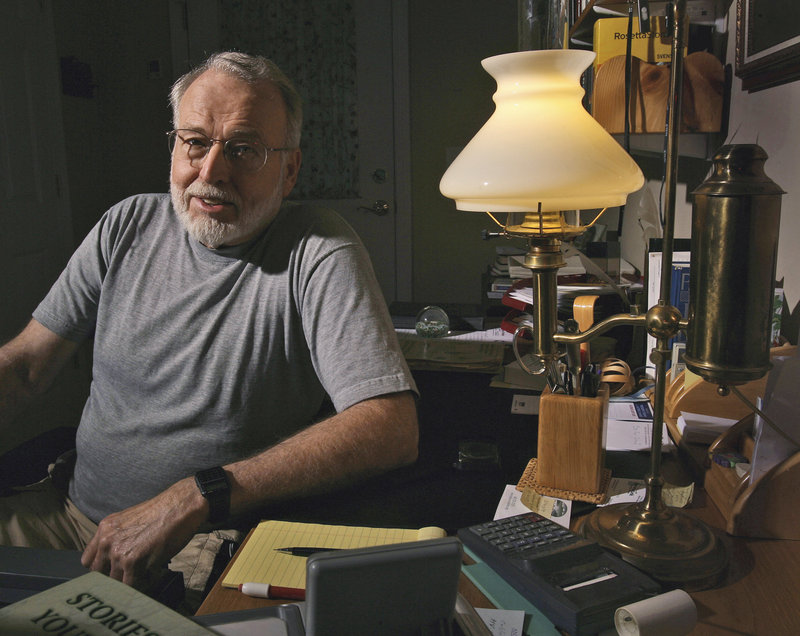

The Rev. Richard Matthews, 72, a retired Methodist minister from Gilford, N.H., finds himself in a financial plight he never imagined possible.

After 46 years in the ministry, he receives just $1,200 a month in retirement income, most from Social Security. He is on food stamps and had to turn his thermostat down to 52 last winter so he could afford to pay his heating bill.

CAREGIVER NOT ALWAYS REWARDED IN KIND

Matthews’ annual pay package was about $75,000 when he retired from full-time duty in 2005 — about half in salary and the rest for housing and other benefits. Yet his pension income is only about $300 a month.

Stock investments once worth $200,000 were eroded in the market meltdowns of 2000 and 2008, and he had to use most of what was left to pay off a mortgage after selling his home at a loss this year.

“I went into this profession not expecting to become a wealthy person,” he says. “I went into this expecting that I would be cared for by the church and the congregations that I served, only to find that when we get to the end of the road I’m no longer cared for. “

Matthews admits to some bitterness at both the church for his meager pension and at “greedy” hedge funds that mismanaged his money. He is moving later this month to Sweden, where he founded and headed a church for 10 years, so he can afford health insurance.

The average pay for a senior minister at a small to medium-sized U.S. church is $70,300, according to a National Association of Church Business Administration survey. About 13 percent of respondents reported getting no retirement benefits, while churches are making very small contributions to the retirement plans of many others, according to the interdenominational Christian organization.

“As ministers start approaching retirement, they all of a sudden say, ‘Wow, I’m behind,”‘ says Simeon May, the group’s CEO.

PROBLEM ACUTE IN NEW ENGLAND

The problem is particularly acute in New England, where the population is older and most churches are small and struggling fiscally as congregations shrink. Many are unable to fund pensions just as many pastors are nearing retirement.

The Rev. Peter Beckwith, 55, pastor at South Gorham Baptist Church in Gorham, Maine, considers himself an exception to the rule in that his thriving church has an excellent retirement plan. But he says many of his peers effectively receive less than the minimum wage, because their pay package includes money that they must pay out for work-related travel and other professional expenses.

Retired clergy in the region and their spouses sometimes have trouble putting food on the table and are dealing with foreclosure and unaffordable medical bills — “some really sad situations,” according to Lisa O’Donoghue, director of clergy family services for the Preachers’ Aid Society of New England.

An aversion to financial matters coupled with a trust in God to take care of things can be counterproductive when it comes to planning for retirement, she notes.

Send questions/comments to the editors.